Smart Ways to Use Property Sale Money: Investing, Saving, and Tax Reduction

Posted By: Blog

Imagine if you had made a real estate investment two decades ago. We all know the effort we put into researching before purchasing our first property. However, let's say you find yourself in a situation where you are considering disinvesting it today. Curious about how the process works? What are your investment options? Let's dive into all of that in this blog!

Let's start by uncovering the compelling reasons that may lead someone to consider divesting their property investments.

Reasons to Divest a Property

1. You Anticipate Flat Returns in the Future

In the past, you could have chosen to invest 20 years ago, convinced it was a profitable option that would provide you with significant returns. And you likely did see those returns. But now, the returns are plateauing. It might be a good idea to cash in on the investment.

2. Investments Made For a Particular Goal

You might have chosen to invest the money for a particular purpose, such as your son's education or your daughter's wedding. Now is the perfect moment to use that investment to cover upcoming expenses.

3. When Migrating to a Foreign Country, Managing Property Can be a Challenge

You might have originally planned to reside in the country and make the most of your property investment. But now, due to work commitments, you are relocating to a different country. As a result, handling property matters from a distance may not be possible. Selling the property and deciding whether to keep the money or reinvest it in another venture could be a better choice for you.

4. When Growing Older and Have Children Abroad, Better to Have Fewer Properties

As we grow older, it becomes essential to start consolidating your investments. This is particularly significant if your children are settled abroad and won't be able to make the most of your real estate assets. Reducing the number of properties closer to you ensures that your children can fully appreciate and utilize them after your time. These are just a few compelling reasons why exploring the possibilities of divesting your real estate holdings is a wise decision.

Key Terminologies to Know While Selling Property and Investing

Exploring the fundamental terms that hold significance in aiding your investment choices is important.

Sale Price

Starting with the sale price represents the amount recorded in the sale deed registered at the sub-registrar office.

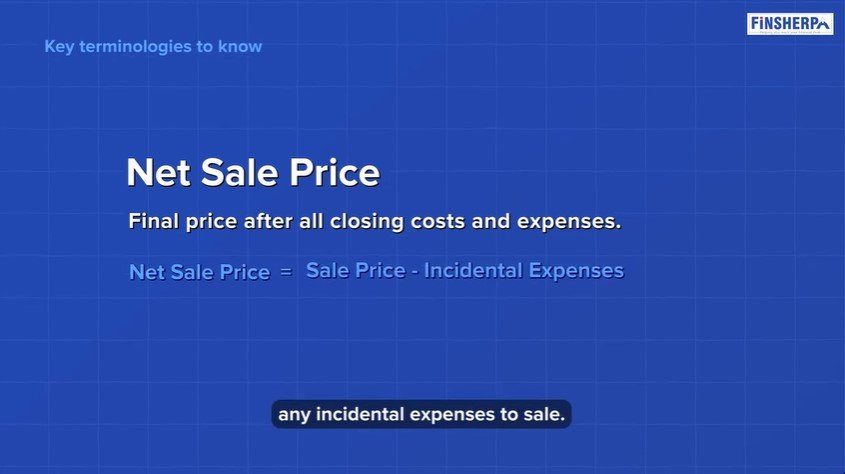

Net Sale Price

Moving on, let's talk about the net sale price. What sets it apart from the sale price? Essentially, the net sale price is the sale price after deducting any incidental expenses related to the sale. These expenses may include brokerage fees paid to a real estate agent or any other costs incurred during the property's sale. To ensure transparency, a payment voucher should be issued, containing all the relevant information, including the PAN number of the recipient.

Purchase Price

Imagine going back in time, 20 years ago, when the property was first bought. The purchase price, mentioned in the sale deed, represents the original price at which the property was acquired. So, in this case, what was the property price stated in that purchasing document?

Index Purchase Price

The idea of the index purchase price is quite interesting. According to the income tax department, each year comes with an indexation benefit matching the inflation rate of that specific year. The index table began at 100 in 2000 - 01 and has now reached around 345. It is expected to rise to 365 or so by the financial year 2024 - 25, resulting in a 4 - 5% index benefit due to inflation for the property seller.

To ensure your purchase price aligns with the current value of the property, it is essential to index it accordingly. This will help you stay on top of the market and make a wise investment decision.

Check out the video link for a more in-depth understanding

Investment Options

Capital Gains Bond

Capital gains are calculated by subtracting the indexed purchase price from the net sale price. This variance is then classified as a capital gain. A capital gain bond is an investment in either Rural Electrification Corporation or IRFC, both of which are Government of India enterprises, under Section 54EC of the Income Tax Act.

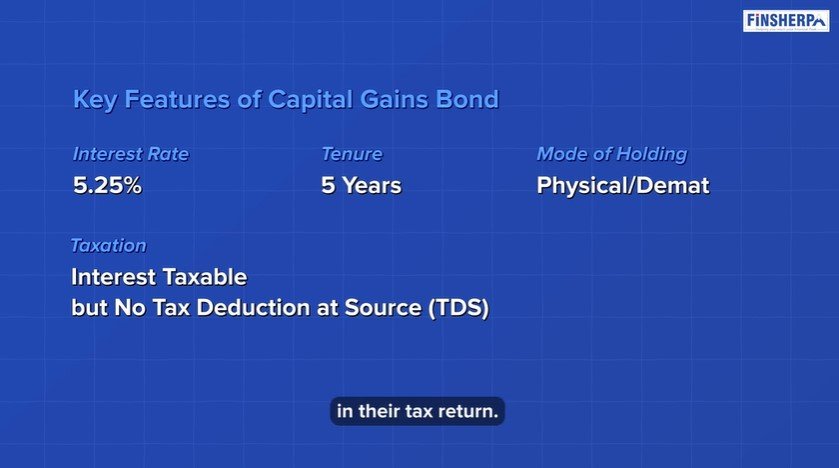

Features Of Capital Gains Bond

Multiple corporations allow investors to deposit money under section 54EC, helping them avoid capital gains. These corporations offer a taxable interest rate of 5.25% per annum. The bond has a duration of five years, so investors must keep their money invested for that period. The bond is available for purchase in either physical or demat form. Interest earned is not subject to tax deduction at the source, however, individuals are required to declare it in their tax return and pay any applicable taxes.

Check out the video link for a more in-depth understanding

Conservative Hybrid Funds

Low-volatility debt funds or hybrid funds are essentially investments that have minimal exposure to equity markets if any at all. Investors can count on these for stability and safety, although the returns they offer are on the lower side.

Aggressive Hybrid Funds

Aggressive equity funds are investments made in aggressive equity mutual funds or stocks. These investments can be highly volatile, with potential fluctuations of 10-15% in either direction. However, this volatility also brings the possibility of good returns. If someone stays invested for five years or more, they can expect a reasonably good return from aggressive equity mutual funds.

Example with Calculation

Capital Gains Bond

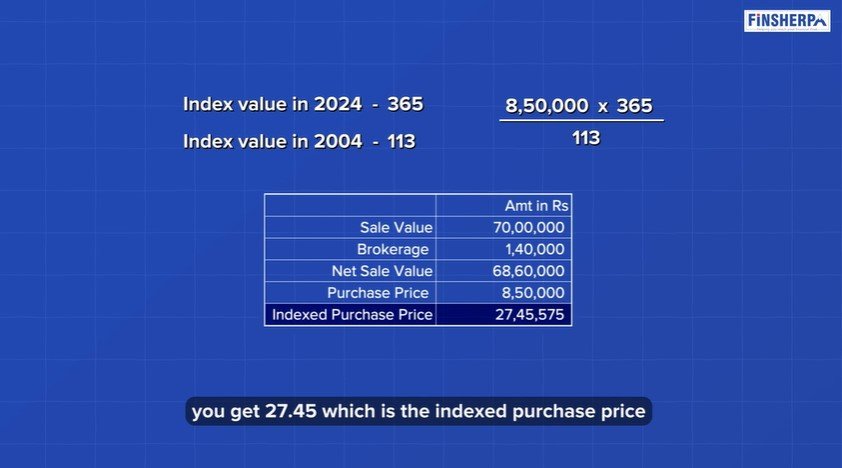

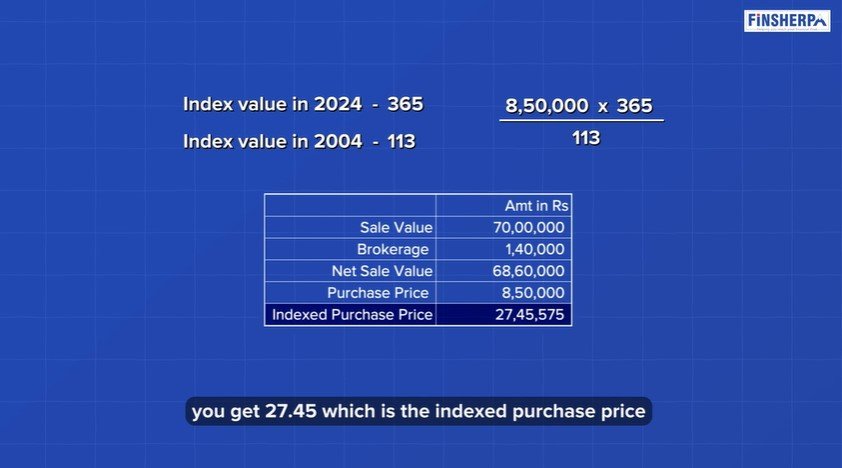

To illustrate a capital gain situation, let's take an example. Imagine a property being sold for 70 lakhs, with a brokerage fee of 2% deducted, amounting to 1.4 lakhs. Consequently, the net sale value is 68.6 lakhs. In this scenario, let's assume the property was bought 20 years ago for 8.5 lakhs. If it is sold in the financial year 2024-25, it is anticipated that the index value will be 365.

The index value on the purchase date, which was in 2004-05, was 113. By multiplying 8.5 Lakhs by 365 and dividing it by 113, you obtain 27.45, which represents the indexed purchase price as of today. Hence, the capital gain amounts to 41,14,000.

There are three investment options for investors who want to avoid paying any taxes. They can invest the entire amount of 41 lakhs in capital gain bonds offered by REC, Power Finance Corporation, or IRFC. By doing so, they can avoid paying capital gains tax. These bonds provide a 5.25% annual return, which is deposited directly into the investor's bank account. If someone were to sum up for five years, the total amount of enjoyment without tax would be 53.13 lakhs, making 41 lakhs become 53.13 lakhs.

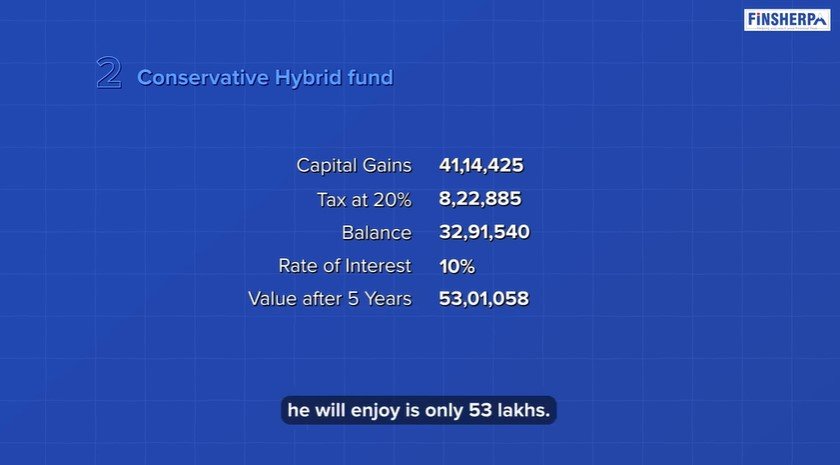

Conservative Hybrid Fund

In the second scenario, the investor decides to pay a specific amount of tax from the total of 41 lakhs and reinvest the remaining balance as they wish. Of the 41 lakhs, 8 lakhs are paid as tax, leaving 32 lakhs to be invested.

If the investor is conservative and opts for a debt or hybrid option with low equity and high debt, they may receive 10% or less over five years. In total, they will only enjoy 53 lakhs.

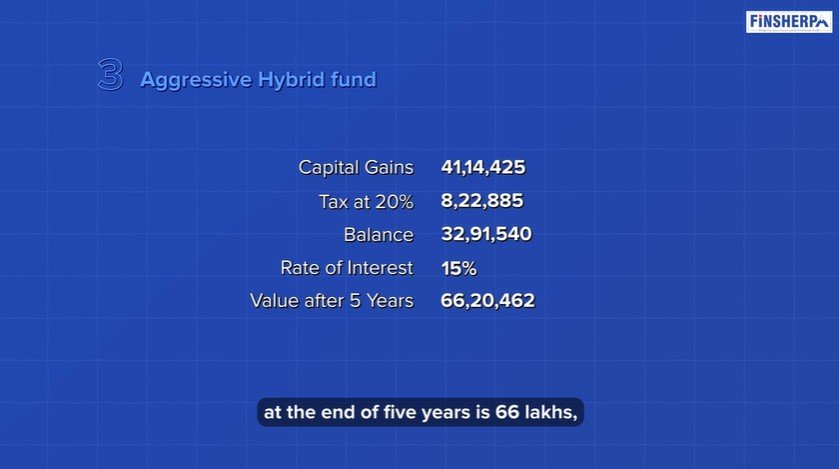

Aggressive Hybrid Fund

The third scenario is like the second one. The investor decides to pay taxes. He decides to invest the remaining 32 lakhs in aggressive equity or mutual funds that can make 15% or more. If this option is chosen, the expected maturity after five years is 66 lakhs, which is much higher.

Check out the video link for a more in-depth understanding

Wrapping Up

The choice of scenario ultimately relies on the investor's temperament. If you consider yourself a cautious investor who prefers to avoid major risks, then we suggest sticking with the capital gain bond. With this option, you can enjoy a guaranteed annual return of 5.25% and, most importantly, save 20% on your upfront tax payments.

So there is a definite advantage for conservative investors to choose this option. You would end up with a reasonably predictable corpus at the end of five years, and you can do what you choose at the end of five years. But if you're capable of taking risks, you're aggressive by nature, then you can afford to pay the 20% tax, and the balance of money could get invested in either aggressive equity or aggressive equity mutual funds which have the potential to generate 15% or more.

You can end up with a larger corpus in five years compared to the conservative option. However, keep in mind that this choice comes with risks and volatility. If you are confident in your abilities, then you should consider it. Ultimately, it depends on your temperament.

If you lean towards a conservative temperament, consider capital gain bonds; however, if you have a more aggressive mindset, opt for stock market-oriented investments.

For the complete video experience, click on this link

Category Finsherpa | Tags