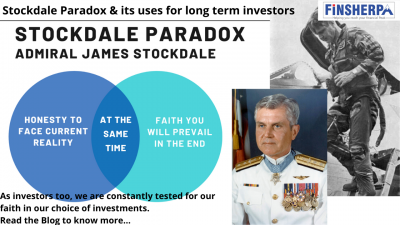

Stockdale Paradox and its uses for long term investors

Posted By: Admin

Admiral Jim Stockdale, was the highest-ranking United States military officer in the “Hanoi Hilton” prisoner-of-war camp during the height of the Vietnam War. Tortured during his eight-year imprisonment, Stockdale lived out the war without any prisoner’s rights, no set release date, and no certainty as to whether he would even survive to see his family again.

In his book, “In Love and War”, he writes that the systemic constraints were so severe that there was never going to be any end to the torture. His captors could come in any day and torture him. He has no sense of whether, or if, he would ever get out of the prison camp. Absolutely depressing situation. We can all survive anything as long as we know it will come to an end, we know when and we have a little control over it. He had no such thing not for 1, 2.. but for 8 long years.

Later in an interview he said “I never ever wavered in my absolute faith that not only would I prevail – get out of this- but I would also prevail by turning it into the defining event of my life that would make me a stronger and better person.

His acceptance of the brutal realities yet unwavering faith that this would end is what came to be known later as the “Stockdale Paradox”.

Today as we face an unprecedented crisis in the form of pandemic, the lessons of Admiral Jim are quite valuable and relevant. While the pandemic is severe as it seems unending, we all have the faith that it will end and when it ends, it will leave us all stronger and better human beings than when it started.

As investors too, we are constantly tested for our faith in our choice of investments, during the course of a week of reviews and meeting with investors one of the most asked questions that I end up answering is the question “Is the Stock market going to crash ?”. Honestly I don’t know , I don’t think any experts can predict that as well. However what we do know is that as long as one is in this in the long term and willing to wait it out, I am sure that our investments will not only emerge stronger but also with far greater profits than before. So can we build up our expectation and mental reserve that if there is a stock market crash, we would hold on to our best investments and give it time to recover rather than succumbing to the temptation of exiting from the market at its worst time thereby incurring losses.

Patience in waiting out dark days and faith that there would be better days ahead when the investments would stand tall again is the cornerstone of a successful investor.

Category Finsherpa | Tags Financial Freedom