_-_finsherpa_1727160556.jpg)

Stock Market Crash: What to Expect and Expert Tips to React Wisely

Posted By: Basecamp

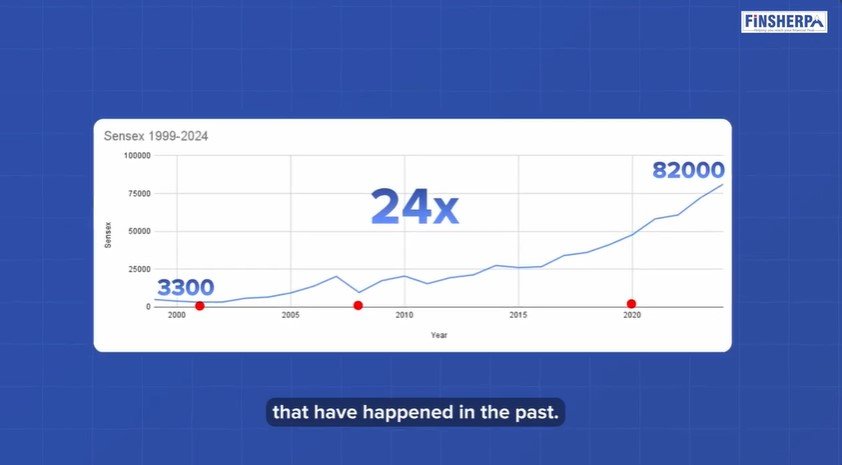

Over the past few weeks, there's been a growing buzz about an impending stock market crash. Many investors, both seasoned and new, are feeling a mix of fear and uncertainty about the future of their investments. The primary keyword, stock market crash, has been at the forefront of discussions, as people are concerned about the impact on their portfolios. In this blog, we’ll explore historical crashes, what they teach us, and how to respond wisely if history repeats itself.

Understanding Historical Stock Market Crashes

The Dot-Com Bubble (2000-2001)

The first major crash we can learn from is the Dot-Com burst. At the turn of 2000, the Indian stock market, along with global markets, was booming with high expectations from the internet revolution. The Sensex peaked around 5400 in early 2000, but reality struck hard. The market corrected sharply, losing almost 50% of its value, bottoming out at 2800 by 2001. The crash was fueled by excessive speculation in internet-based companies. Despite this, the market rebounded within three years, reaching back to its previous highs.

The Global Financial Crisis (2007-2008)

The next significant fall came during the global financial crisis in 2008. Indian markets were not spared as the Sensex plunged from over 20,000 to nearly 9700, a staggering 65% drop. It was a challenging period, but the markets managed to claw back to their previous highs in about two years. This recovery was marked by volatility, yet it demonstrated the resilience of long-term investments.

COVID-19 Market Crash (2020)

The most recent crash occurred in early 2020 when the COVID-19 pandemic gripped the world. Markets fell swiftly, dropping by 24% in just days, from a pre-crash high of around 40,000 on the Sensex. However, thanks to quick actions by global governments and financial institutions, the recovery was also swift. Within six months, the markets had regained their lost ground, showcasing the potential for rapid rebounds in response to effective crisis management.

Check out the video link for a more in-depth understanding

What These Market Crashes Teach Us

History shows us that while stock market crashes are inevitable, so are recoveries. The underlying economic factors that drive markets remain robust over time. Understanding this can help investors stay calm and avoid rash decisions during market downturns.

Expert Tips to React Wisely During a Market Crash

1. Stick to Your Long-Term Goals

Your financial goals, whether for retirement or other long-term plans, shouldn't change due to short-term market movements. Remember that the market’s recovery over time can help you achieve these goals, even if a crash occurs.

2. Maintain Your Asset Allocation

Stick to your asset allocation strategy. If your equity-debt ratio is disrupted due to a market fall, rebalance your portfolio to take advantage of the lower equity prices. This strategy, known as buying the dip, can enhance your long-term returns.

3. Avoid Panic Selling

Panic often leads to losses during market crashes. Instead of selling, consider holding your positions or even adding to them if you have the capacity. This careful method can bring great rewards when the market improves.

Check out the video link for a more in-depth understanding

Why The Market Will Likely Bounce Back

There are several reasons why a potential crash might not last long. Firstly, the influx of long-term investments from Indian retail investors through SIPs provides a strong foundation for recovery. Secondly, both institutional and retail investors have become more savvy, viewing crashes as opportunities rather than disasters. Finally, India’s growing economic appeal makes it a strong contender for global investment, which could drive market recovery in the event of a downturn.

Final Thoughts

Stock market crashes are part and parcel of the investing journey. They are neither predictable nor avoidable, but understanding their history and maintaining a disciplined approach can turn them into opportunities rather than setbacks. So, if a crash does happen, remember to stay calm, stay invested, and keep your eyes on your long-term goals. The market, as history has shown, will bounce back.

For the complete video experience, click on this link

Category Finsherpa | Tags