Highlighting the Essence: 4 Stories from 'Same as Ever' by Morgen Housel Explored

Posted By: Ameen

Welcome to FINSHERPA! I hope you're enjoying the blogs we're sharing with you. They're all about money and are meant to be rewarding. Today, we'll delve into the "Same as Ever" book review by the renowned author Morgan Housel.

Morgan Housel has become widely renowned for his first book, The Psychology of Money. If you still need to read it, I strongly advise you to do so. This book has the power to bring you wealth in more ways than one.

Be sure to check out the link to view our video on the book 'The Psychology of Money’.

In this blog, we will discuss the next book, Same As Ever, which has a truly enticing title and reading experience insights. Before we dive into that, let's take a moment to talk about Morgan Housel. Morgan Housel is a fund manager and a partner at the Collaborative Fund in the US. Moreover, he is widely recognized for his prolific writing.

About the Writer - Morgan Housel

He writes for The Washington Post and used to write for Motley Fool. He has written two books, The Psychology of Money, a popular bestseller and now he has written another book called Same as Ever. The great thing about Morgan's writing is that it is simple and easy; even a ten-year-old can read his book and understand what he is saying.

He opts for simple words instead of jargon to convey complex and emotional messages. Rather than fixating on numbers and similar aspects, he tends to explore the behavioral side of human beings. This approach makes his work captivating, and he enhances it further by incorporating stories to support his theories. In a rapidly changing world, his work remains consistently interesting.

Check out the video link for a more in-depth understanding

What's Inside the Book? - Same as Ever

The presence of AI and machine learning has revolutionized everything, causing significant changes. However, amidst all the transformations, this book reminds us that not everything is changing. It highlights the numerous things that remain constant, urging us to take a step back from the noise and make better judgments based on these unchanging elements.

This book is truly fascinating. It consists of 23 chapters, each sharing an intriguing message through captivating stories or incidents that are relatable to most people.

Let me share a few stories to provide you with a glimpse of Morgan's perspective in his writing.

Calm Is The Foundation Of Crazy

In the first story, he discusses how calmness is the basis for chaos, which is quite interesting. He suggests that good times pave the way for bad times, and vice versa. It's funny how this pattern also applies to our stock markets. If we take a look at the late 1990s and early 2000s, the Y2K phenomenon caused the stock prices of many IT companies to skyrocket.

That's when the next crash came into being. It was in September 2001 when the Twin Towers explosion sent shockwaves through the stock market, resulting in a significant crash. The I.T. sector also faced a major meltdown during that period. It was from this point onward that the next wave of optimism began to take shape, and the groundwork for the next major bull run was laid in 2001 when the markets hit rock bottom.

In 2008, it skyrocketed to nearly 10 times the market growth during those seven years. That's the kind of remarkable growth we're talking about. He emphasizes the significance of recognizing that the pinnacle of success often coincides with the emergence of the seeds of the next major downfall. Similarly, the depths of an economic downturn often pave the way for the next significant upswing.

So, remember this. As the saying goes, it's not finished until it's finished, you know?

Too Much, Too Soon, Too Fast

Morgan also mentions the dangers of excessive talking, premature actions, and rapid progress. Anything associated with steroids is likely to result in unfavorable outcomes. Presently, we reside in a startup era where individuals expect immediate transformations in numerous areas, particularly those who are into investing financially.

A few of these endeavors anticipate speedy outcomes, but often they are unattainable in the usual manner. As a result, some promoters opt for fraudulent bookkeeping, which eventually gets exposed, or they step back and are subsequently replaced in the entire process.

He advises to rationalize your expectations and prioritize sustainability. He believes that sustainability is more valuable than speed. Following this approach will help in maintaining a solid and fair environment.

Check out the video link for a more in-depth understanding

Elation and Despair

Combining optimism and pessimism is a lovely concept. Some individuals are consistently positive and experience success, while others are consistently negative.

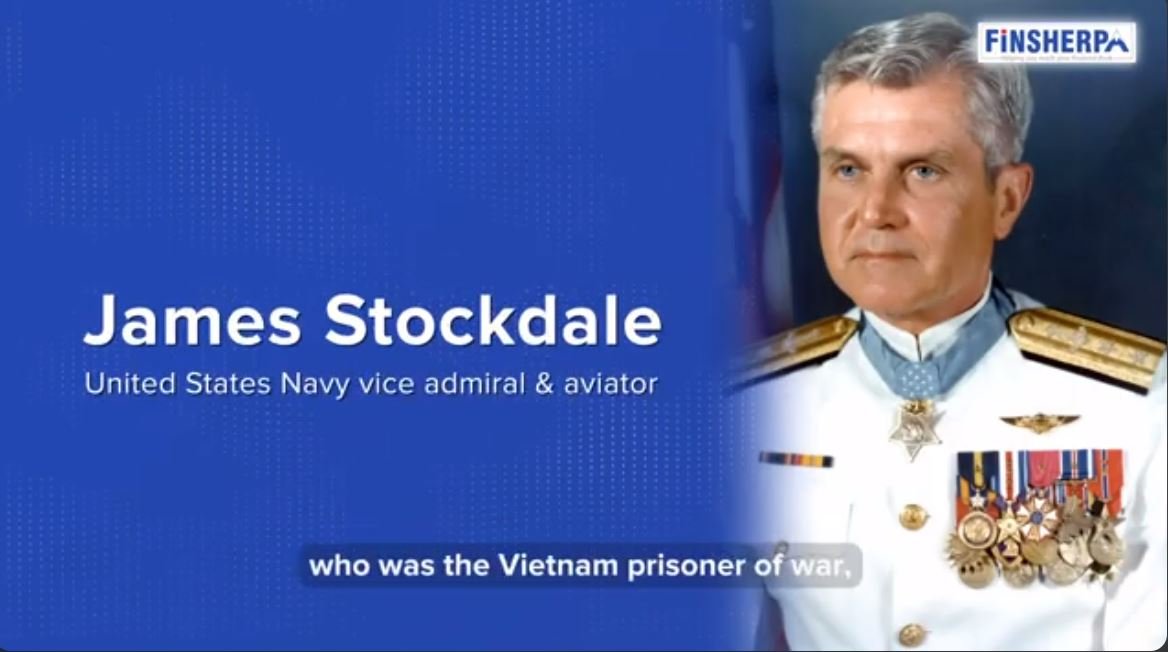

Their actions hold a certain level of reason. Nevertheless, he emphasizes the importance of blending optimism and pessimism. He narrates a remarkable story about Admiral Stockdale, a prominent American military figure who endured eight years of captivity during the Vietnam War and was eventually freed when the war came to an end.

Throughout his time in Vietnam, he faced unimaginable torture, humiliation, and inhumane treatment for a span of eight years. Miraculously, he managed to survive. In a later interview, a reporter asked him how he was able to endure such hardships.

He responded by explaining that his unwavering optimism fueled his belief that he would eventually be reunited with his family. Nevertheless, he also acknowledged the grim truth that each morning at 6 a.m., he would once again endure 8 hours of torture.

Morgan suggests that combining optimism and pessimism in the right proportion is essential to achieving success in any given situation.

Risk Is What You Don't See Coming

How ironic! In February 2020, corporations were still busy making plans for the years 2020, 2021, and 2022 and hosting grand employee events and festivities.

Within a month, everything took a turn for the worse and continued that way for several months. Nobody could have predicted or anticipated the arrival of COVID. That's the risk. You can prepare and take measures to mitigate various risks, but there will always be something unexpected that catches you off guard.

Check out the video link for a more in-depth understanding

Morgan suggests focusing on being prepared rather than trying to predict. Being prepared is more effective than making predictions. If you try to predict, you will likely be incorrect. Even after taking care of everything else, there will always be something unexpected that will affect you.

Who Should Read ‘Same as Ever’?

He advises being ready for anything that might happen. This will help you overcome any challenges that arise. There's no need to spend time trying to predict the next major disaster.

I've made an effort to discuss these four stories with you, but there is a multitude of wisdom in these 23 stories. Who should be the audience for this?

For those who are interested in personal finance and money-related topics, this book is a must-read. However, even if you're not specifically looking for financial advice, it still offers valuable insights for everyday life.

Go ahead and get your hands on this book, which is 'Same as it has always been'. You won’t have any regrets.

For the complete video experience, click on this link

Category Finsherpa | Tags