Keyman Insurance: Protecting Your Business from Financial Loss

Posted By: Blog

Life insurance and health insurance are familiar terms to most of us. However, have you ever heard of Keyman Insurance? Who exactly is considered the key man? Today, we will delve into the differences between life insurance and Keyman insurance in our blog.

Who is Called the Keyman?

Every organization, regardless of size, relies on key individuals for successful operations. These individuals could be the director, promoter, sales director, or highly skilled employee leading a specific project. The absence of such a key person would significantly impact the organization's financial performance, earning them the title of a key man.

What is Keyman Insurance Policy?

Keyman insurance is a type of insurance that organizations use to protect themselves when they have important individuals in key roles. If one of these individuals passes away, the organization may experience a certain hardship until they can find a suitable replacement or implement a process to mitigate the loss. During this period, the organization experiences a financial setback.

Check out the video link for a more in-depth understanding

How Does Keyman Insurance Protect Your Business from Financial Loss?

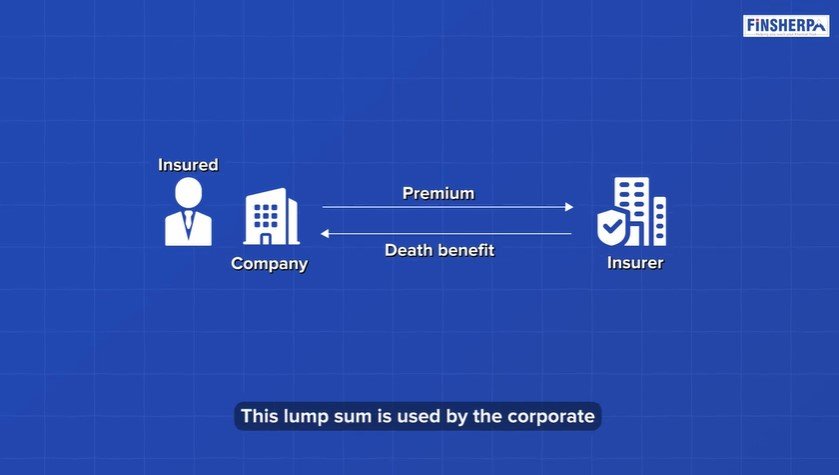

The purpose of keyman insurance is to assist the organization financially in recovering from this loss. How does the keyman insurance work? The company is the one who applies for the policy, while the key man is the one who is insured. The company receives a lump sum payment upon the death of the key person. The company then uses this payment to handle any financial difficulties that arise as a result of losing the key man. Financial instability can come from lower profits or higher costs, like hiring and training a replacement for a lost employee.

Both of these situations involve extra expenses, making this beneficial for corporations. If the key person outlives the policy term, the company does not receive any benefits. This simply means that a certain cost was incurred. Since it's a term insurance policy, the costs are not very high.

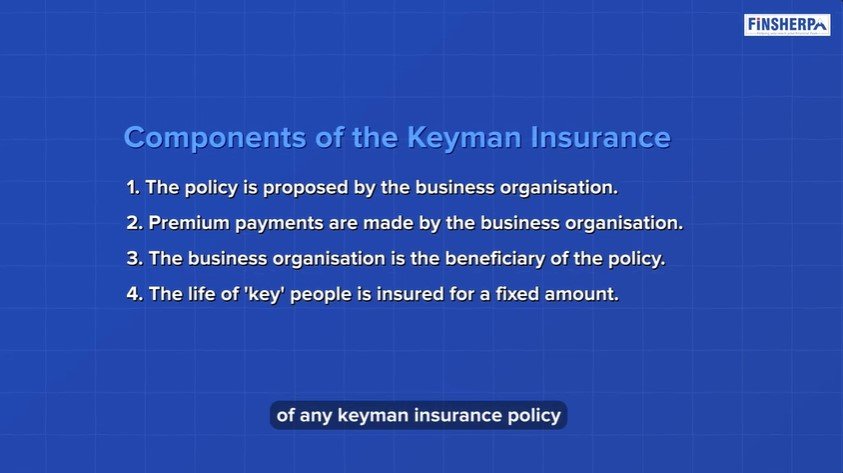

4 Components of Keyman Insurance Policy

- The company is the proposer of the policy. It can be one keyman or several keymen within the organization.

- Premiums are covered by the organization and are eligible for deduction from the organization's profit and loss.

- The organization benefits from this policy by increasing its profits.

- When someone passes away, the organization receives a fixed amount of money called the sum assured.

Check out the video link for a more in-depth understanding

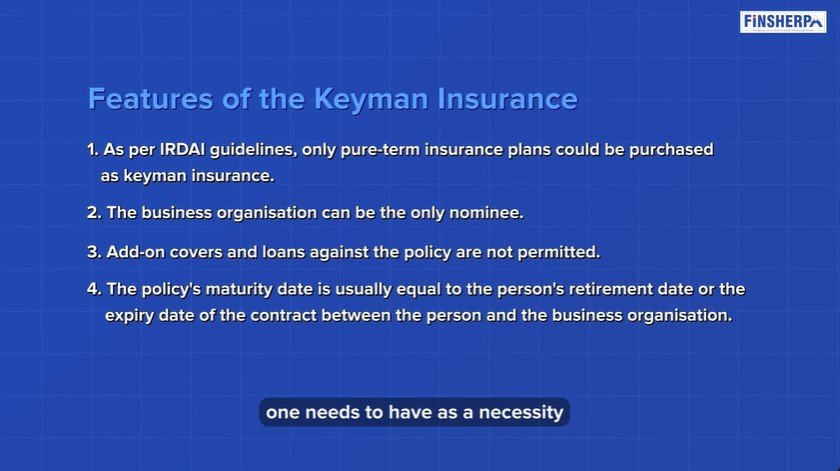

Features of the Keyman Insurance

- As per IRDAI guidelines, keyman insurance can only be offered as a pure-term plan.

- The organization's policy should always prioritize the company as the nominee. This ensures that in case of any individual losses, only the money should be returned to the company.

- Attachments to the policy are not permitted. This means that you cannot include a critical illness rider or take out a loan against these policies. Such actions are prohibited.

- The policy term should correspond with the employee's tenure at the organization, ending either at retirement or the conclusion of their contract period.

These are the essential features required when creating keyman insurance for a company. Keyman Insurance was developed to address the vulnerability organizations face when key individuals are no longer able to contribute. These individuals are essential to the organization's success, and their absence could lead to financial strain. Thus, keyman insurance provides financial protection for the organization.

Advantages of the Keyman Insurance

- Losing an individual is a significant loss that cannot be filled. Nevertheless, there is a financial aspect that aids the company. It ensures that the company has enough money to navigate through the challenging period of the initial months or even a year after losing that individual. This period is crucial for any organization.

- Additionally, for organizations looking to support the individual's family, having access to funds enables them to give back. It is important to recognize that the loss of an individual not only affects the organization but also has a greater impact on the family. At that specific time, the organization needs to possess a lump sum to offer to the family member.

- The organization writes off the premiums paid as expenses in the profit and loss account, making it a beneficial tax-saving tool. Keyman insurance is beneficial for organizations as it encourages key employees to stay longer, creating a sense of loyalty among employees and their families. This loyalty helps to cultivate a more loyal workforce and promotes loyalty within the organization.

- Finally, companies with keyman insurance see that when they are publicly traded, their stock prices remain steady due to the protection of key individuals.

The presence of keyman insurance ensures that companies do not face financial distress when a key person is no longer available. Moreover, this insurance feature contributes to higher valuations for unlisted companies. Therefore, corporates can greatly benefit from the keyman insurance benefits by incorporating this coverage.

Check out the video link for a more in-depth understanding

Taxability of the Keyman Insurance Policy

The company can consider the premiums paid for keyman insurance as allowable expenses, which can be deducted from its profits. Moreover, this insurance offers tax protection to organizations if they experience the loss of a keyman.

When the corporation or company receives a lump sum, it is considered as taxable income from the business. Although there is a taxation aspect involved, the organization still has a substantial amount of money to help them navigate financial difficulties caused by the loss of a keyman.

It is worth mentioning that, although unverified, there have been instances where the policy can be assigned to the employee or their family after the payment of premiums. This applies specifically to limited premium term insurance, such as 20-year term insurance with premium payments for only six or five years, once the initial five-year premiums have been fulfilled.

If the policy is assigned to the employee after the premium paying term, any incident that occurs until the policy matures will result in the individual receiving the policy maturity amount as tax-free income. Even if the individual is no longer with us, the family can still benefit financially to a certain extent.

It should be noted that income tax implications are involved in this matter. It's not as straightforward as I mentioned earlier, but some corporations have utilized this approach in the past. Furthermore, when the assignment takes place, the surrender value of the policy is considered, leading to the inclusion of a specific amount of perquisite tax in the employee's income tax.

This situation is considered a grey area under the Income Tax Act, so it's essential to proceed with caution. I strongly advise consulting your chartered accountant for expert guidance on how to proceed.

Check out the video link for a more in-depth understanding

Summary of The Keyman Insurance

Keyman insurance is fundamentally a term life insurance policy that offers coverage for a specific key individual within an organization. However, it does not offer any additional benefits such as loans, critical illness riders, or the option to receive the premium amount back. The sum assured or the key man does not pay the premium and does not receive any financial benefits for themselves or their family from the policy.

The presence of a keyman is of utmost importance for an organization to handle the financial implications that arise from their absence. Furthermore, the premium paid for keyman insurance can be deducted from the company's profit and loss account, offering a valuable tax cover.

In addition, the lump sum received by the corporation is frequently allocated to assist the family of the deceased employee, providing them with a sense of relief. Consequently, this initiative aids in strengthening employee loyalty toward the organization.

Keyman insurance is a highly attractive option for small and medium-sized businesses, as the loss of a key employee can significantly affect operations.

For the complete video experience, click on this link

Category Finsherpa | Tags