The Pros and Cons of Investing in Invoice Discounting

Posted By: Ameen

Business financing options like invoice discounting, invoice factoring, and receivable financing have been around for a while. Interestingly, they have now emerged as investment opportunities for retail investors. Are these choices advantageous for investors? Let's explore the potential advantages and disadvantages of these options in this blog.

What is Invoice Discounting or Receivable Financing?

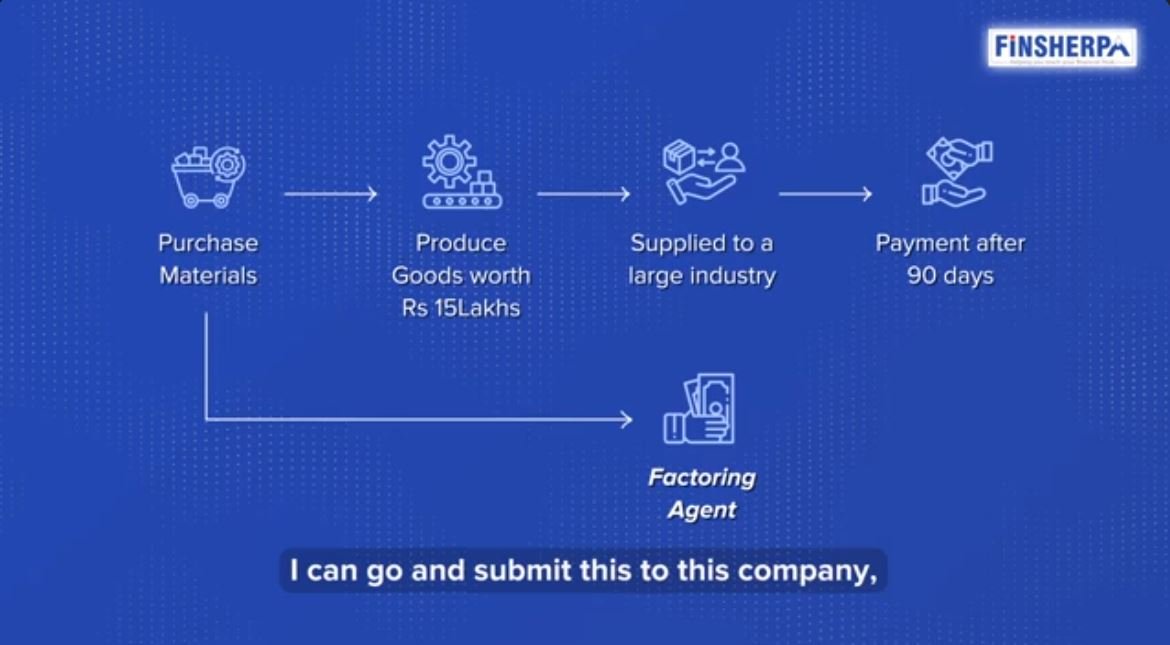

Before we proceed, let's grasp the concept of invoice discounting or receivable financing. A lot of small and medium-sized businesses need more capital at their disposal. They utilize this capital to purchase raw materials, manufacture finished goods, and then supply them to another industry. Based on the trade agreement, the industry will repay the money to the manufacturer within a credit period of either 30, 60, or 90 days. If the credit period is 90 days, the manufacturer will receive the money back on the 90th day.

That's quite a long time. If I find myself short on cash, I'll have to wait a whole 90 days before I can make more of my goods. In the meantime, I'll have to gather the money I've paid my vendor and go through the process of collecting and managing it. On the other hand, if my business is booming and there's high demand, waiting for the money to come back before producing again just won't cut it. I have customers eagerly waiting for me!

So, what should I do? Are there any better options? Yes, there are better alternatives. If my products are being used by large industries, well-known companies, and blue chip companies, there are numerous financing options to choose from. What does that mean? Let's say I have supplied materials worth 15 lakhs to a well-known industry.

As per the terms, I'm entitled to receive a payment of Rs 15 lakh after the 90-day credit period. That's what the agreement with that company outlines. Now, I can either wait for the entire 90 days to receive the full amount or I can approach a factoring company or agent who can promptly provide me with an immediate cash flow solution.

Check out the video link for a more in-depth understanding

There is no need to wait for 90 days. I'll have it on day one. Once I supply the material and have my bill endorsed, I can submit it to this company and have them endorse it for the factoring company. This way, I'll receive immediate cash flow. However, I will be charged interest for the 90 days.

Even though the amount I'll receive will be significantly lower, I'll receive it instantly. This allows me to reinvest the money back into my business and keep the production cycle going without any financial worries. In this way, factoring proves to be extremely beneficial, particularly for small and medium-sized enterprises.

Example Scenario

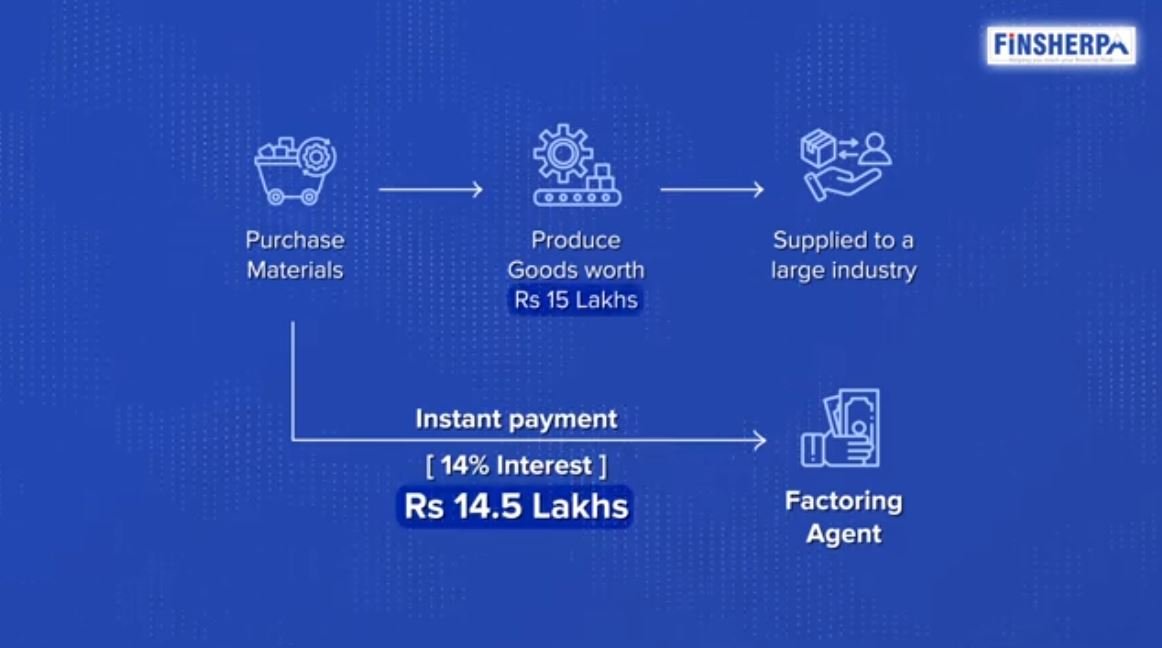

I supply materials worth 15 lakhs to a reputable organization, offering them a 90-day credit period. Given their strong creditworthiness, I face a choice: waiting the full 90 days for direct payment or opting for immediate capital by discounting the payment with a factoring or finance company.

Assuming the company charges a 14% interest rate, I will immediately receive 14.5 lakhs on day one, but I will incur a financing cost of ₹50,000. I can choose to accept the 14.5 lakh and proceed with my production smoothly. The finance company will handle the task of collecting the 15 lakhs from the reputable company after 90 days. Here's how a factoring arrangement operates.

Now, let's discuss the advantages and disadvantages.

Advantages of Invoice Discounting

Immediate Cash Flow

Getting capital instantly is advantageous as it eliminates the need for waiting. This allows me to maintain a fast pace in my production cycles without any interruptions. Additionally, I can achieve this with a very small amount of capital.

Reduced Credit Risk

Small companies face difficulties in collecting money, but there is a solution. They can rely on a financing company to handle the collection process for them. This advantage makes it easier for these companies to manage their finances. They don't need to waste time, so they can focus on producing and supplying. Collecting is someone else's responsibility.

Check out the video link for a more in-depth understanding

Disadvantages Of Invoice Discounting

The fee charged by the financing company can be relatively high

One of the drawbacks is that I may have to allocate a significant amount of money towards financing costs, which I could have easily avoided. To illustrate, if I have a 15 lakh invoice, I could potentially lose ₹50,000 upfront. That ₹50,000 could be the profit margin on my product. As a result, I could unknowingly end up giving away all the profit from that product due to this circumstance.

Customer relationships can be affected

Sometimes, certain companies aren't too keen on fostering this kind of connection. Hence, when it comes to collecting payments, if someone other than the supplier takes charge, the company doesn't perceive the supplier as a respected individual. Relationships can become complicated when someone other than the provider of the goods handles the invoice collection. Yeah, it seems like there are problems on that front too.

Invoice Discounting From A Finance Company's Perspective

From the point of view of a financing company, how does this work? It's all about offering secured lending options that are relatively safe. I mean, I can't say they're 100% safe, but they're definitely on the safer side. Why? They will be dealing with a well-established company. So the risk involved is extremely low. That's why I'm more than willing to finance it and get my money back within 90 days.

The period is quite short, only 90 days, so it's unlikely that the risk will go bad so fast. If someone had a good reputation 90 days ago, it's unlikely they would get into bad debt in such a short time. This short period is beneficial for the financing company.

How Does Invoice Discounting Work as an Investment?

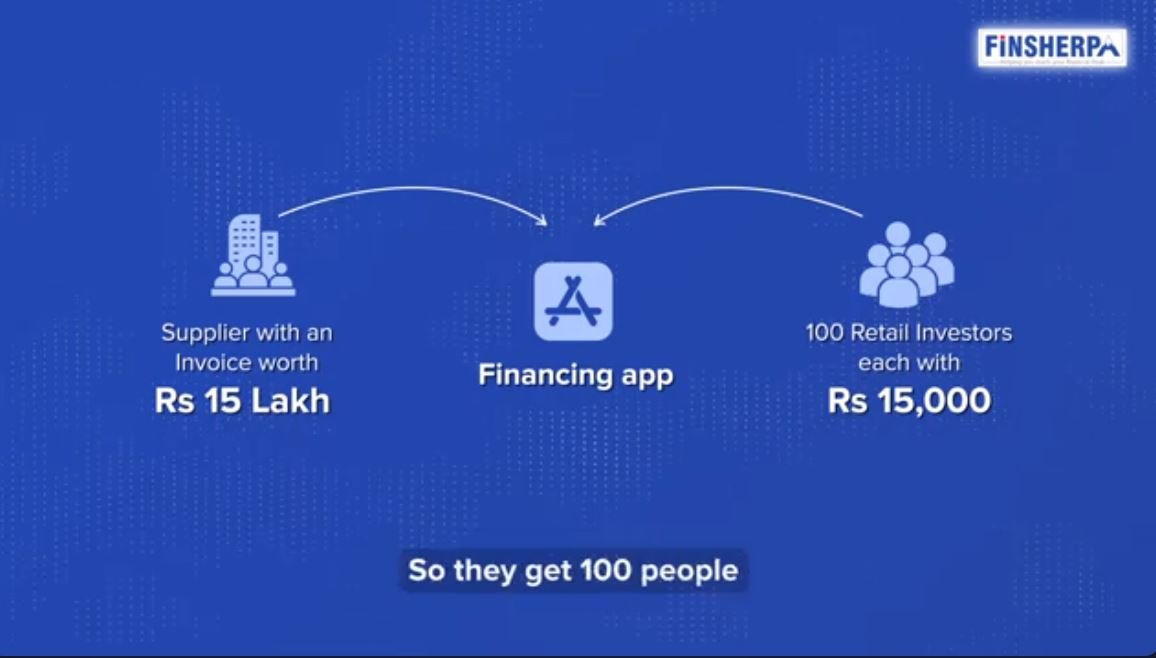

How does this work as an investment? Currently, there are several newly introduced financing apps. These apps serve as a connection between retail investors and small to medium-sized enterprise suppliers for financing purposes. For instance, if a supplier has a bill of Rs 15 lakh, there might be approximately 100 small investors who are willing to invest small amounts of money.

The amount is not big. Perhaps ₹15,000 per person, and when these hundred individuals come together, they contribute to the financing of this option. Essentially, these apps serve as a bridge between the two extremes, utilizing technology as a tool. They gather 100 people with an average of ₹15,000 and connect them to a single invoice of 15 lakhs, which they are confident will be collected.

In addition to this, they also verify the creditworthiness of both the individual and the company by conducting a credit check. This guarantees that the person is eligible for the credit. Hence, they carry out an additional level of credit evaluation, which the companies would have done too.

These apps make sure that the invoices are only from well-known big companies. They have a verified list of companies that they can supply. This brings a level of predictability to the money returned to investors. These apps have filled a gap in the market and are fulfilling a demand.

The Business Perspective on Financing Apps

Business professionals are increasingly relying on these applications as traditional banks are unable to fulfill their credit requirements. These apps come to the rescue by offering loans at a higher interest rate. The app keeps a small portion and returns the rest to the investor. The banks offer a 6-7% interest rate, but businessmen, despite the higher 12% interest rate from the apps, still find satisfaction in this short-term credit option. This arrangement can be repeated multiple times within a year, making it advantageous for all parties involved. However, it's important to note that these apps are still in their early stages.

Getting Started with Invoice Discounting: Key Tips for Beginners

If you're someone who is ready to take a small risk and has faith in trying out some of these investments, go ahead and take that leap. I've gathered a few tips that you might want to take into account.

Start with a Small Amount

Start with extremely small amounts. You can even begin with ₹5,000. Test it out and if it proves successful, gradually increase your investment over time. Be careful not to invest excessively. Always set a specific limit. I would suggest not exceeding 3 to 5% of your total funds. This ensures that you are taking risks, but the level of risk remains extremely limited. It is certainly worth giving it a try.

Check out the video link for a more in-depth understanding

Verify RBI Registration of the Apps

Before lending money to any apps, it is important to check a few things. Firstly, make sure that the apps are registered with the Reserve Bank of India (RBI). This provides an extra level of security, ensuring that they won't disappear and you won't lose your money.

Understanding Risks: Read the Fine Print Carefully

It is crucial to carefully read and understand all the terms and conditions mentioned in the fine print before starting your journey. It's essential to have a clear understanding of the potential risks that come with it. One major risk is the possibility of a dispute between the material supplier and the manufacturer, leading to a loss of funds. Despite this significant risk, if your investment is minimal and you are mentally prepared to accept it, you can proceed and give it a shot.

Final Thoughts on Invoice Discounting

Personally, I wouldn't go for something like this. If the rate of return by the end of the period is less than 12%, it just doesn't seem like a risk worth taking. But hey, that's just my opinion. I'm not suggesting you should or shouldn't choose this option. The decision is completely in your hands, so go ahead and make that call.

To put it simply, when you explore invoice discounting, you'll discover a range of opportunities and factors to consider. The flexibility and the ability to access cash quickly make it a smart choice for businesses handling their finances. However, it's essential to consider drawbacks such as fees and customer relationships.

By exploring financing apps, you can find convenient solutions that are easily accessible. Whether you're new to the business world or have years of experience, understanding the pros and cons will help you make well-informed decisions. So, make the most of the benefits, but keep in mind potential problems in the world of business finance; knowledge is key.

Category Finsherpa | Tags Financial Freedom