_-_finsherpa_1731486756.jpg)

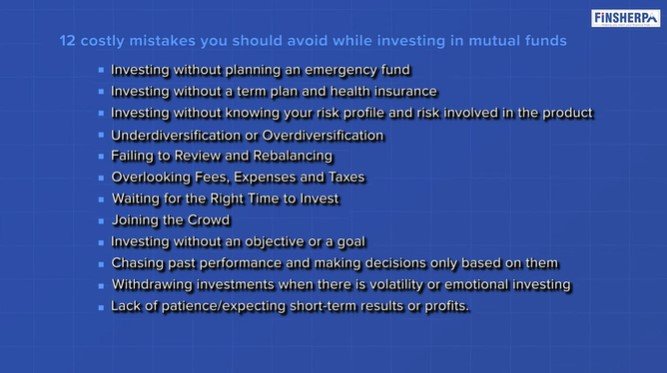

12 Costly Mistakes to Avoid in Mutual Fund Investing: Your Essential Guide to Smarter Decisions

Posted By: Blog

Mutual fund investing offers great potential for long-term wealth creation, but it’s not without risks. Many investors make avoidable mistakes that can cost them significantly. Understanding these pitfalls and knowing how to avoid them can help you maximize your returns and achieve your financial goals. In this guide, we’ll walk through the 12 most costly mistakes people make when investing in mutual funds and provide tips on how to sidestep them.

12 Common Mistakes to Avoid for Smarter Mutual Fund Investing

1. Skipping the Emergency Fund

Before diving into long-term mutual fund investments, it’s crucial to establish an emergency fund. This fund acts as a financial cushion, typically covering three to nine months of living expenses. Having this safety net ensures that you won’t have to liquidate your long-term investments in a crisis. Without an emergency fund, you risk cashing out your mutual fund investments during a market dip, locking in losses that could have otherwise been avoided.

2. Neglecting Risk Management

Risk management should be your priority when beginning your investment journey. Whether you’re young or experienced, it's essential to have adequate insurance coverage—especially health and term life insurance—before you commit money to long-term investments. By mitigating personal risks early, you can invest with peace of mind, knowing that unexpected events won’t derail your financial plans.

Check out the video link for a more in-depth understanding

3. Failing to Align Investments with Goals

Investing without clear financial goals is like driving without a destination. Whether your goals are retirement, buying a home, or funding your children's education, aligning your mutual fund investments to your specific goals increases your chances of success. Research shows that investors who set clear objectives are far more likely to reach them. Define your goals early and invest accordingly for a greater chance of achieving them.

4. Waiting for the 'Right Time' to Invest

There’s no perfect time to start investing. Many people wait on the sidelines, thinking they need to wait for the market to “cool down” or for the ideal entry point. But in reality, the best time to invest is always now. Waiting for the “right time” often leads to missed opportunities. The key is to focus on a long-term investment horizon, where timing becomes less important.

5. Ignoring Risk Tolerance

Understanding your risk tolerance is critical before choosing your mutual fund investments. If you’re someone who panics during market fluctuations, you may want to avoid high-risk funds. On the other hand, if you’re comfortable with risk, you might explore equity funds or more volatile options. Make sure your portfolio matches your risk appetite to ensure you don’t lose sleep over market ups and downs.

6. Over or Under-Diversifying Your Portfolio

Diversification is an important part of a balanced investment strategy, but it’s equally important to get it right. Under-diversifying means concentrating too much on a few investments, leaving you vulnerable to market swings. On the other hand, over-diversifying can make it difficult to track your portfolio and lead to diluted returns. Aim for a well-balanced mix of assets to ensure you are optimizing your portfolio without spreading yourself too thin.

7. Following the Herd

It’s easy to get caught up in market trends, especially when everyone around you is investing in the latest hot sector or stock. However, following the herd can be dangerous. Always assess whether an investment aligns with your financial goals and risk tolerance. Just because your friend is investing in a particular fund doesn’t mean it’s the right choice for you. Stick to your strategy and avoid making decisions based on others’ actions.

Check out the video link for a more in-depth understanding

8. Not Considering Fees, Expenses, and Exit Loads

Before investing, make sure you understand the fees associated with your mutual funds. These can include management fees, entry/exit loads, and other charges that can erode your returns over time. Regular plans typically carry higher fees than direct plans, so choose wisely. Understanding these costs helps you make more informed decisions and maximize the potential of your investments.

9. Overlooking Tax Implications

Mutual fund investments have tax implications that depend on how long you stay invested. Short-term capital gains (for investments held less than a year) are taxed at a higher rate than long-term gains. For equity funds, long-term holdings are taxed at a more favorable rate. By being aware of the tax advantages, you can make better decisions regarding your investment timeline and overall strategy.

10. Relying Solely on Past Performance

While past performance can give you some insights into how a fund has managed previous market cycles, it’s not a guarantee of future results. Don’t be swayed by a fund’s past performance alone. Look for funds that are well-managed, align with your goals, and are likely to perform well in the future. A fund’s current trajectory and management are often more important than its historical returns.

11. Emotional Investing

Emotional investing is a trap many new investors fall into. Watching the news or reacting to market volatility can lead to knee-jerk decisions like pulling out investments during a downturn. Successful investing requires a long-term view and a calm approach. If you allow emotions to dictate your investment strategy, you risk making costly mistakes. Keep your eyes on your long-term goals and avoid reacting impulsively to short-term market fluctuations.

12. Lack of Regular Review and Rebalancing

Mutual fund investing isn’t a “set it and forget it” strategy. Regularly reviewing your portfolio’s performance is key to ensuring that it stays aligned with your financial goals. Over time, your portfolio may become unbalanced, with some assets performing better than others. Use rebalancing tools to adjust your investments and maintain an optimal mix of asset classes.

Final Thoughts

Mutual fund investing can be a powerful tool for building wealth, but it requires a strategic approach. By avoiding these 12 costly mistakes, you can improve your chances of success and make smarter investment decisions. Remember, mutual funds are not a one-size-fits-all solution, and it’s essential to align your investments with your financial goals, risk tolerance, and investment horizon. Stay informed, stay patient, and watch your wealth grow.

For the complete video experience, click on this link

Category Finsherpa | Tags