_-_finsherpa_1722937614.jpg)

Comparing the New vs. Old Tax Regime: Understanding Tax Slabs, Capital Gains, and Mutual Fund Changes

Posted By: Blog

In the constantly changing landscape of personal finance, understanding the nuances between the new and old tax regimes is crucial for making informed financial decisions. With the recent unveiling of the new budget, the finance minister has introduced several key changes affecting tax slabs, capital gains, and mutual fund taxation. This blog will delve into these aspects, compare them to the old regime, and analyze how they impact taxpayers. Whether you're interested in tax savings, capital gains, or mutual funds, this guide will help you navigate the financial maze.

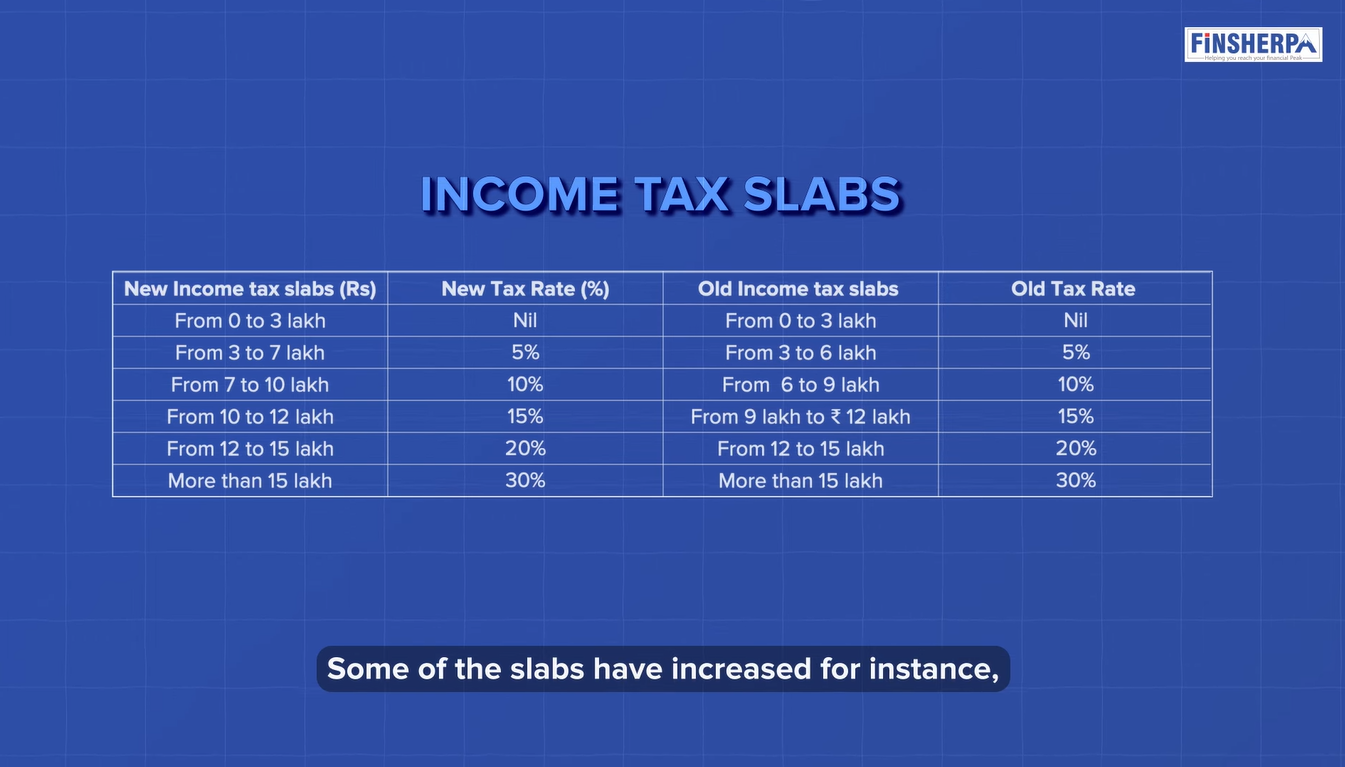

Understanding the New Income Tax Slabs

The updated personal tax slabs are the first feature of the new tax regime. Here’s a look at the changes:

- 5% Taxation: Now from ₹3-6 lakhs to ₹3-7 lakhs.

- 10% Taxation: Increased from ₹6-9 lakhs to ₹7-10 lakhs.

- 15% Taxation: Raised from ₹9-12 lakhs to ₹10-12 lakhs.

- 20% Taxation: Remains the same for ₹12-15 lakhs.

- 30% Taxation: Remains the same for over ₹15 lakhs.

Check out the video link for a more in-depth understanding

Benefits of the New Regime

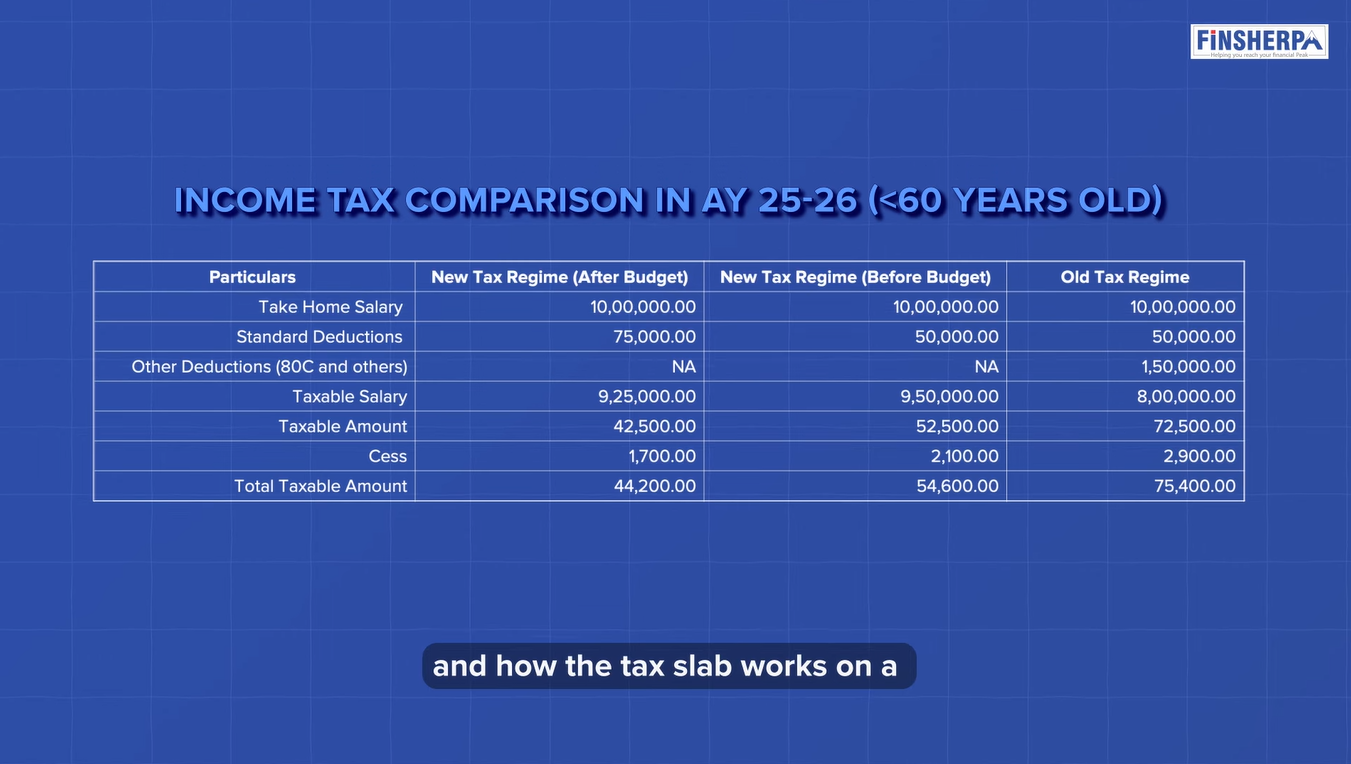

Standard Deduction Increase: From ₹50,000 to ₹75,000.

Tax Savings: For example, a person under 60 with a ₹10 lakh salary now pays ₹44,200 instead of ₹54,000.

Old Regime Costs More: The same income under the old regime would cost ₹75,400.

Income Tax Comparison Before and After Tax Regime Update For People Less Than 60 Years

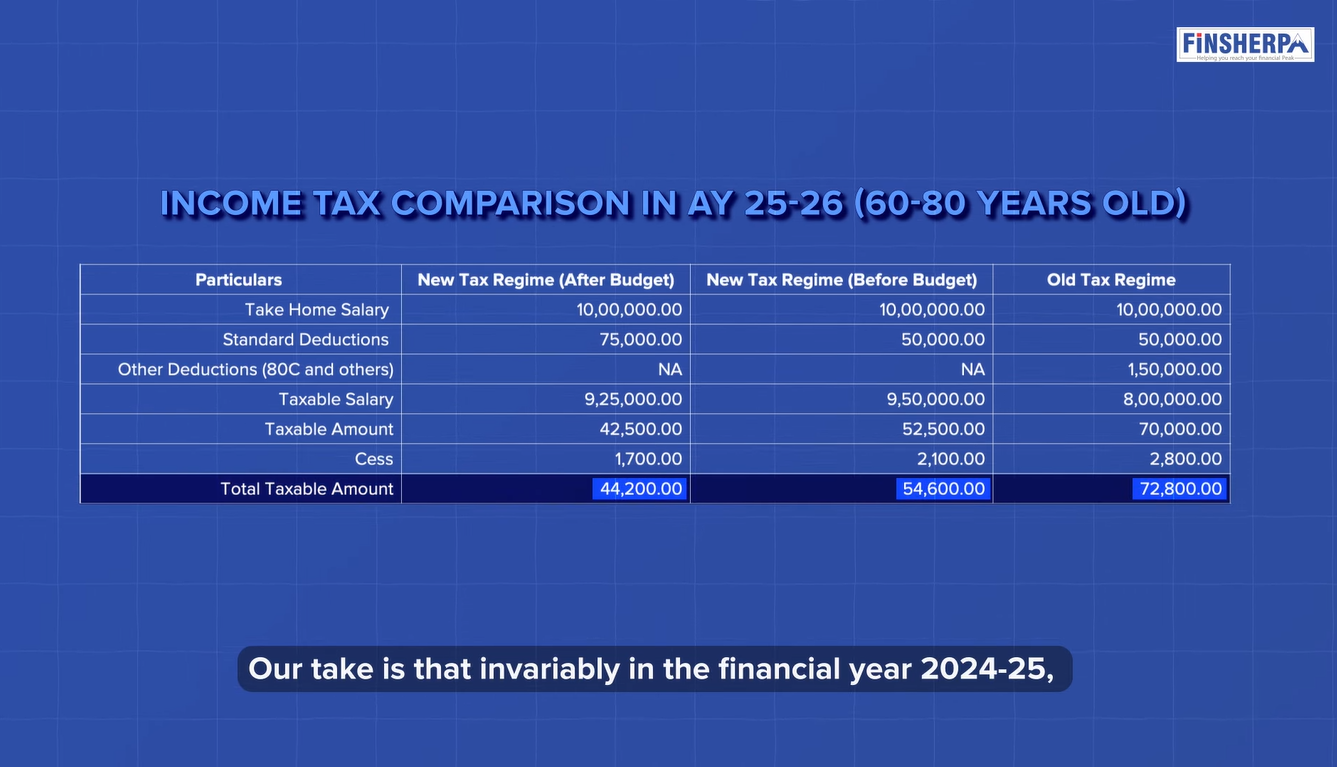

Income Tax Comparison Before and After Tax Regime Update For People from 60-80 Years

Who Benefits the Most?

The changes seem to benefit most taxpayers, particularly the salaried class, by offering relief against inflation. Our analysis shows that the new regime provides substantial tax savings for individuals below 60 and those aged 60-80.

Key Takeaway:

The government's nudge towards adopting the new tax regime seems justified, especially for the financial year 2024-25.

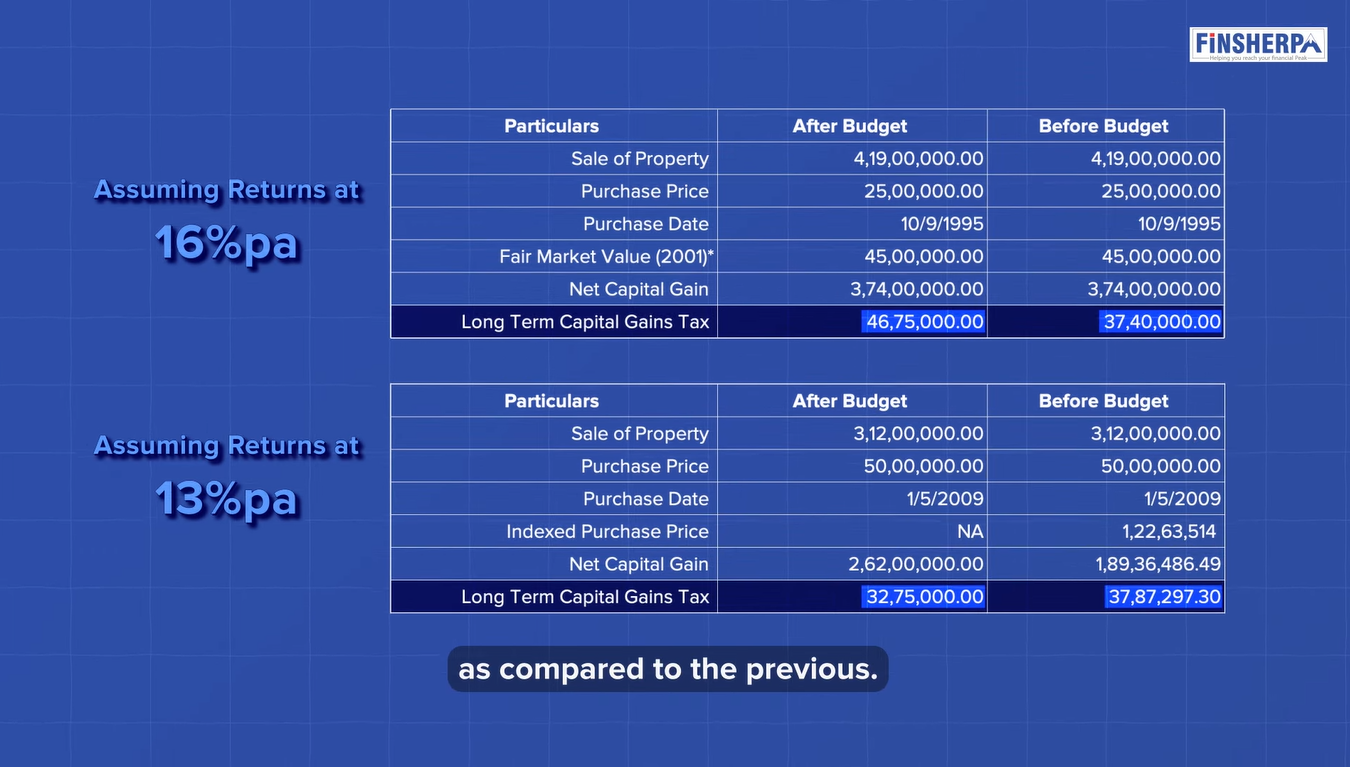

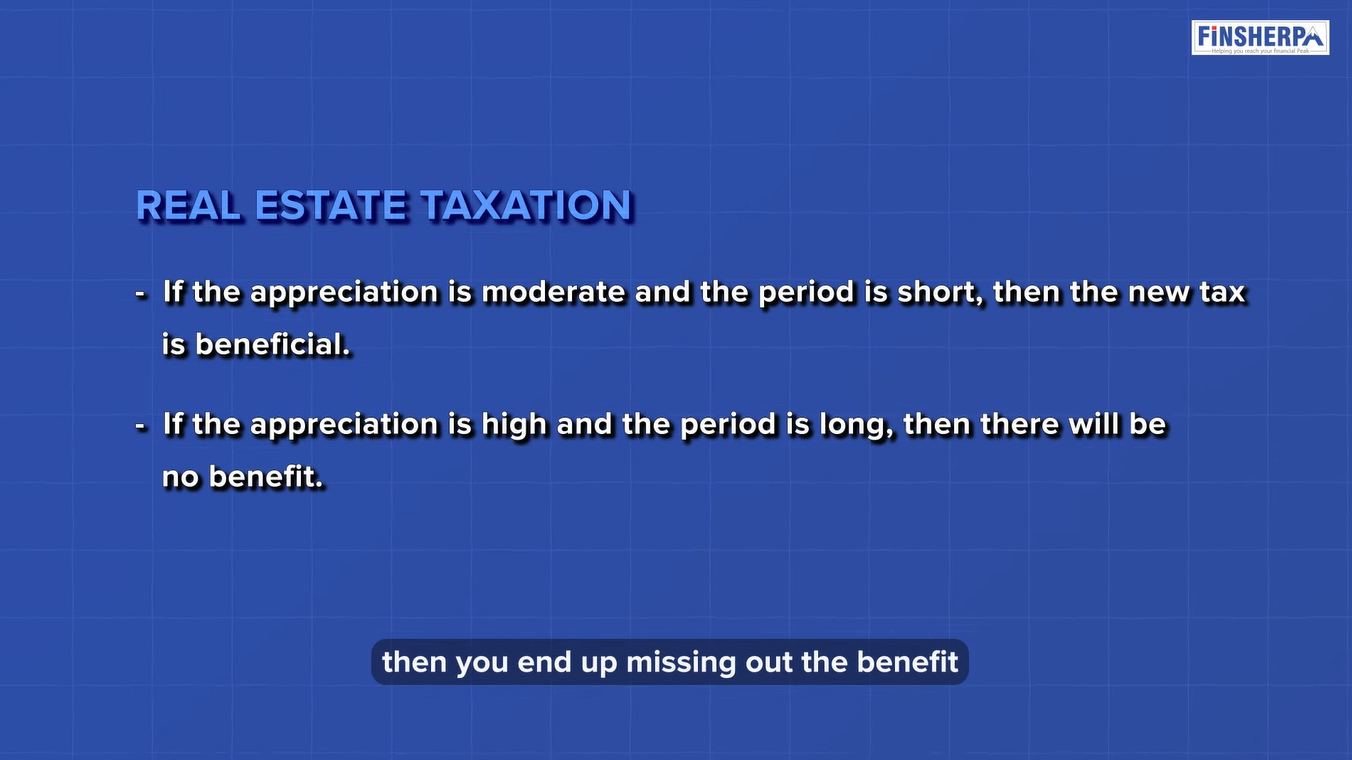

Capital Gains: Real Estate Impact

Elimination of Indexation Benefit

A significant change in the new regime is the elimination of the indexation benefit for real estate bought before 2001. The long-term capital gains tax rate has increased from 10% to 12.5% without indexation. Here’s how it plays out:

- Pre-2001 Properties: Calculated at 2001 rates, with increased tax liability.

- Growth Scenarios:

- High Growth (16%): Higher tax post-budget.

- Moderate Growth (13%): Lesser capital gain post-budget.

- Low Growth (9%): Higher tax before budget.

Comparing the New vs. Old Real Estate Taxation Comparison

Who Wins With The New Regime?

For short-duration holdings and moderate growth, the new tax regime may be more beneficial. However, properties with high appreciation over long periods face higher taxes without indexation.

Key Takeaway: If your property saw significant appreciation, the new regime might cost you more in taxes. For moderate growth, it's more advantageous.

Check out the video link for a more in-depth understanding

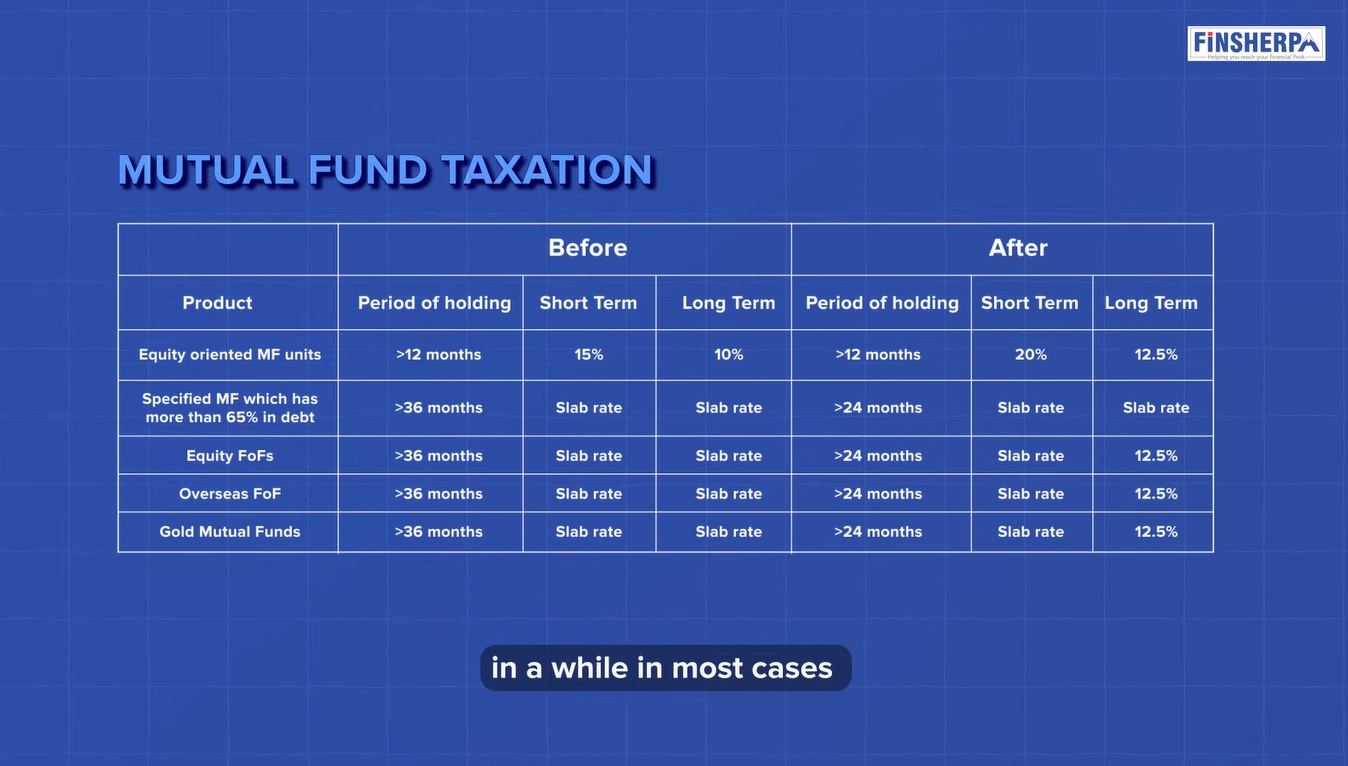

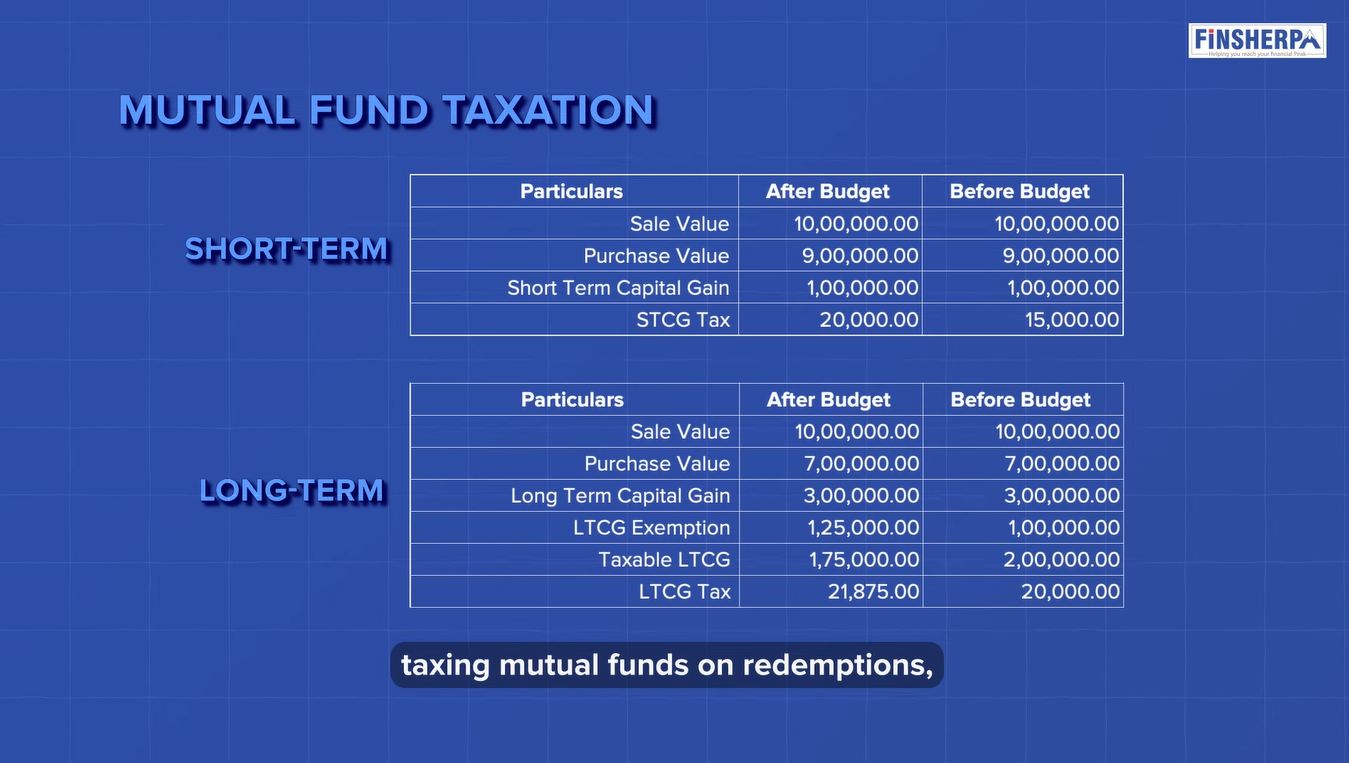

Mutual Fund Taxation Changes

Key Changes in Mutual Fund Taxation

The third pillar of the new tax regime revolves around mutual funds, with specific changes to taxation policies:

- Equity Funds: Short-term tax increased from 15% to 20%.

- Long-Term Capital Gains: Increased from 10% to 12.5%.

- Equity Fund of Funds: Now 12.5% for 24 months holding.

Impact on Different Fund Types

Overseas Fund of Funds, Gold Fund of Funds, Equity Fund of Funds:

Long-term status achieved in 24 months (down from 36 months).

The long-term tax rate is set at 12.5%.

Other Funds:

Taxation remains consistent.

What Investors Need to Know

The government aims to secure a fair share from the growing mutual fund industry, which remains prosperous. While these changes increase tax liability on mutual funds, they also reflect the growing prosperity in the market.

Key Takeaway: Investors will see higher taxes on redemptions, especially in equity-oriented funds. Staying informed can help manage these costs effectively.

Check out the video link for a more in-depth understanding

Conclusion: Which Tax Regime Should You Choose?

The revised tax framework presents a clearer and more organized approach to personal taxation. The government's efforts to shift taxpayers towards this regime are evident in the changes across personal tax slabs, real estate, and mutual funds.

Considerations for Taxpayers

- New Tax Slabs: Beneficial for most people earning a salary.

- Real Estate: Evaluate based on property appreciation and holding period.

- Mutual Funds: Higher taxes but opportunities for strategic planning.

Ultimately, the decision between the new and old tax regimes depends on individual financial circumstances and goals. Consulting with a financial advisor can help tailor a strategy that aligns with your unique needs.

For the complete video experience, click on this link

Category Finsherpa | Tags