_-_finsherpa_1721651678.jpg)

Top Investment And Cash Flow Tips for Senior Citizens to Ensure Financial Security in Retirement - Part 2

Posted By: Blog

In a previous blog post, we delved into the topic of cash flows, focusing specifically on senior citizens and retirees. I recall breaking down post-retirement life into two different phases. The first phase spans from age 60 to 75, during which individuals are typically more active and may have a greater need for money. Therefore, the generation of cash flow becomes particularly crucial during this stage.

In the next stage, from 76 to around 90 or even beyond, and throughout the rest of our lives, we may not require as much cash flow. However, due to inflation, the amount may still stay the same. We went into great detail about this, but in this blog, we won't be discussing it. Instead, We'll let the numbers do the talking. We'll explore how we can make these goals a reality.

We've showcased a range of real fund performances in the hybrid funds category. Senior citizens and retirees have the opportunity to invest and generate a steady cash flow. Additionally, we'll explore government-guaranteed options such as the Senior Citizens Saving Scheme, providing a secure and guaranteed return for those interested. Let's get started!

Government Guaranteed Investments - A Safe Choice for Senior Retirement Planning

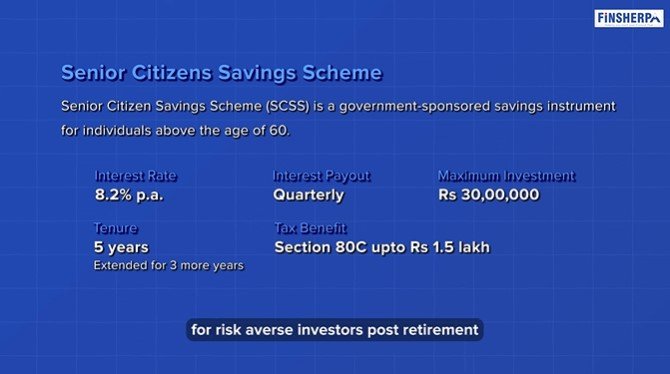

1. Senior Citizen Savings Scheme

The government provides investment opportunities for consistent returns. The initial option is the Senior Citizens Savings Scheme, open to individuals aged 60 and above. The annual interest rate is 8.2%, paid quarterly. The maximum investment amount is 30 lakhs Rupees, and the investment period is five years.

After the initial period, investors can prolong it for three more years. It qualifies for Section 80C deductions, but the investor must pay tax on the interest. It's a popular choice for risk-averse retirees looking for a steady income.

2. Post Office Monthly Income Scheme

Have you heard about the Post Office Monthly Income Scheme? It's currently providing a 7.4% interest per year and it's a five-year investment. You have the option to invest either 9 lakhs individually or 15 lakhs jointly. You can receive the interest monthly and even open a savings account at the same post office. The interest can be credited to this account, and you can also get a chequebook to use just like a regular bank. It's a pretty popular investment choice, especially since post offices are found in every neighborhood and can be easily managed there.

3. Government Of India Floating Rate Bonds

The Indian government offers floating rate bonds with an 8.05% interest rate, paid every six months on January 1st and July 1st. The maturity term for these bonds is seven years. Senior citizens can opt for early encashment, but the interest earned on these Government of India bonds is taxable. The interest rate may change every six months, depending on the prevailing interest rate. This product has no limit, so you can invest as much as you want and receive a regular cash flow.

4. LIC Pradhan Mantri Vaya Vandana Yojana

Previously, there was an additional option called LIC’s Vaya Vandana Yojana, which was a guaranteed pension scheme offered by the government of India in collaboration with LIC. However, it has been discontinued as of March 31, 2023.

Check out the video link for a more in-depth understanding

Hybrid Mutual Funds for Senior Citizens' Retirement Planning

Looking for a reliable source of income during retirement? Hybrid funds offered in mutual funds can be a practical choice. By combining equity and debt assets, these funds aim to generate a specific return for investors. In this part, we will explore four choices for retirees to invest in hybrid funds and receive a steady cash flow. This cash flow can be managed through a Systematic Withdrawal Plan.

1. Equity Savings Fund

One potential choice to consider is the Equity Savings Fund, which involves investing a portion of the funds in equities and another portion in debt, as the name implies. In general, the equity portion is limited to 40%, so it's often less than that. The typical percentage is around 20-25% on average. This makes it a relatively safer choice compared to more aggressive equity funds.

In a real-life scenario where we backtested this from 2012-2022 if an investor had invested 1.2 crores in equity savings funds, they could generate a return of ₹50,000 every month.

After withdrawing 50,000 each month for ten years, they would have accumulated a sum of 1.5 to 2 crores. It's important to note that this is based on a sample of funds and does not represent all possible outcomes. The average rate of return for the selected funds ranged from 7.5% to approximately 9%. Let's take a look at the potential performance of this fund. If you have about eight units, it could be a great option for you as it offers a reliable level of security and a consistent 6% return on investment.

2. Balanced Advantage Fund

The fund to consider is the Balanced Advantage Fund, also known as the Dynamic Asset Allocation Fund. It follows the same numbers, timeline, and 10-year period, with a monthly draw of 50,000 for every 1.2 crores.

The portfolio holds a sum of 28 to 35 million at a rate of 12.5 to 14.8. These funds have a slightly higher return rate. Balanced advantage funds are very flexible, with the equity portion fluctuating between 40% and 60%. Normally, it makes up 40-50% of the total portfolio, but it's considered an equity fund because the fund manager uses a 10-20% buffer.

If 40% is equity and 40% is debt, then the remaining 20% will be used for arbitrage products categorized as equity. This fund will then have over 60% equity, making it qualify as an equity mutual fund for tax purposes. Typically, these funds will have at least 40% equity, and sometimes as much as 50 or 60%. So they are a little bit more aggressive in terms of equity exposure. But combine it with debt to generate a much higher return for the investor.

3. Aggressive Hybrid Funds

Next is the aggressive hybrids fund, which is characterized by holding a minimum of 65% of its portfolio in stocks at all times. Along with this, 34% is allocated to debt. These funds cater to individuals who are looking for a mix of equity and another asset class, rather than investing solely in stocks (100% equity). The debt portion provides some stability to the portfolio, but it's unlikely to be funded below 65% to maintain the tax benefit. Therefore, these funds are considered very high risk compared to the other three we've discussed.

4. Multi-Asset Funds

We are now going to review the last fund, which falls under the category of Multi-asset. This fund will have 33% invested in stocks, 33% in gold, 33% in bonds, or a combination of these. These funds are generally safer as they are diversified across three different asset classes.

In the current example, after 10 years of investing and contributing ₹50,000 every month, the funds have grown to a balance ranging from 1.9 crores to approximately 2.4 crores, generating a return of 9 to 11%. This demonstrates the past performance of multi-asset funds.

Check out the video link for a more in-depth understanding

Wrapping Up

If you're a senior citizen or investor looking for a safe and steady return, consider an Equity Savings Fund as your top choice for systematic withdrawal. It's a more conservative option for generating returns. Multi-asset funds and balanced advantage funds are good options. If you're willing to take on more risk, consider aggressive hybrids. With the numerous choices available, senior citizens can now approach retirement with confidence and ease, knowing that there are ways to effectively plan their cash flows for the future.

Hopefully, I've been able to show you that there are plenty of ways for senior citizens and soon-to-be retirees to establish a long-term cash flow, whether it's through safety precautions or by utilizing hybrid solutions.

For the complete video experience, click on this link

Category Finsherpa | Tags